estate tax changes in reconciliation bill

All major provisions of the House Ways Means Committees budget reconciliation tax bill would cut 2022 taxes on average for households making 200000 or less. Is on at least some changes to.

Senate Draft Of Build Back Better Reconciliation Bill Currently Stalled By Sen Manchin Would Finance Nearly 1 Million Affordable Homes Over 10 Years Novogradac

It depends what day it is.

. The expiration of the current laws estate tax exemption 24 million for married taxpayers would be accelerated by the House billcurrently it. The reconciliation bill is not yet complete and we dont know what tax changes of Bidens American Families Plan will survive. House of Representatives introduced a reconciliation bill that includes.

Major tax changes in draft reconciliation bill. Estate and gift tax exemption. As the budget reconciliation bill goes up for a final Senate vote real estate partnerships should be evaluating how to adjust to the potential tax changes.

107-16 among other tax cuts provided for a gradual reduction and elimination of the estate tax. On November 1 2021 the House Rules Committee reported out the Build Back Better Act Reconciliation Bill which leaves out most. Reconciliation Bill to Target Trusts Estates and the Wealthy.

In 2010 the estate tax was eliminated. The latest version a. Growth and Tax Relief Reconciliation Act of 2001 EGTRRA.

Valuation discounts would be disallowed on nonbusiness assets based on the lack of marketability or. Five Tax Implications of the Budget Reconciliation Bill for Retirement Savers. The current 117M 1 estate and gift tax exclusion was provided under a temporary law.

The latest draft of the US Congress budget reconciliation Bill omits most of the previously proposed tax changes that would have affected US estate planning. The Ways Means Reconciliation Bill Would Raise Taxes On High Income Households Cut Taxes On Average For Nearly Everyone Else. Estate is 10000000 Exemption 0.

13 released the draft text of their proposed tax-raising provisions which was the subject of a. Trust Estate Strategies Protected in New Tax Proposal. Estate Tax 15000000 X 40 6000000.

For trust and estate planning purposes. Even without any act of Congress the exclusion will be cut in half effective January 1 2026. The whole bill should go down and for many more reasons than the.

2021 Reconciliation Bill. The Future of Estate Planning With NFTs. Potential Tax Law Changes Impacting Estate Planning.

This means the current inflation-adjusted exemption of 11700000 per person would be reduced to approximately 6000000. Thursday 04 November 2021. Estate Tax 10000000 X 40 4000000.

Instead it contains three primary changes affecting estate and gift taxes. Last week the House Ways and Means Committee released a draft of proposed tax law changes to include in a reconciliation bill. Revised Build Back Better Bill Excludes Major Estate Tax Proposals In late October the House Rules Committee released a revised version of the proposed Build Back Better Act Reconciliation Bill.

Potential Tax Changes With the 2022 Fiscal Year Federal Budget deadline of October 1 st rapidly approaching House Democrats presented a preliminary tax proposal targeting high earners wealthy estates and corporations to fund Bidens proposed 35 trillion infrastructure spending package. Fredrikson Byron PA. At the same time the bill would raise taxes substantially.

Death in 2022. Gift in 2021 of 0. Most of the major proposals that would create substantial changes in the estate planning arena were not included.

At this writing President Biden is in Rome for the G20 Summit to be followed by the UN Climate Change Summit in Glasgow. As negotiations over spending and taxes in a potential budget reconciliation bill tentatively the Build Back Better Act are ongoing in Congress Democrats on the House Ways and Means Committee on Sept. Estate Tax 15700000 x 40 6280000.

Update - Tax Proposals of the House Ways and Means Committee. Under EGTRRA the estate tax exemption rose from 675000 in 2001 to 35 million in 2009 and the rate fell from 55 to 45. Congressional Democrats are still wrangling among themselves over what provisions or tax law changes are or arent in the formerly 35 trillion Build Back Better bill.

The new reconciliation bill that was introduced in the House of Representatives eliminates some of the more significant tax changes that were proposed in the original bill approved by the House Ways Means Committee in September. The many changes floated since the presidential and congressional elections of 2020 would have reduced the. What tax hikes are in the social policy and climate change bill that Democrats are trying to pass by year-end.

Tuesday October 5 2021. This analysis was updated to contain the November 4th amended changes to the cap on the state and local tax SALT deduction. The amended change would raise the cap to 80000 from 2021-2030 and revert back to 10000 for 2031.

This preliminary analysis is still available here. The draft legislation was expected to be included in a larger budget reconciliation bill but as of. Estate is 16000000 Exemption 1000000.

Gift in 2021 of 11000000. While it is uncertain whether any of these proposals will be adopted and if so in what form several of the proposals would dramatically change common estate planning techniques and may require immediate attention. The proposal reduces the exemption from estate and gift taxes from 10000000 to 5000000 adjusted for inflation from 2011.

USA October 1 2021. The estate tax exemption would be reduced as of January 1 2022 from its current 117 million to 5 million adjusted. On September 27 the US.

Last month the House Ways Means Committee. Estate planning changes dropped from US budget reconciliation Bill. Estate is 21000000 Exemption 5300000.

Here are some changes the budget reconciliation tax law would bring about.

Everything In The House Democrats Budget Bill The New York Times

Retirement Death Tax Bank Reporting Provisions Stripped From Reconciliation Bill For Now

Billionaires Tax On Capital Gains Invites Tax Collection Volatility

Tpc The Ways Means Reconciliation Bill Would Raise Taxes On High Income Households Cut Taxes On Average For Nearly Everyone Else

Tpc The Ways Means Reconciliation Bill Would Raise Taxes On High Income Households Cut Taxes On Average For Nearly Everyone Else

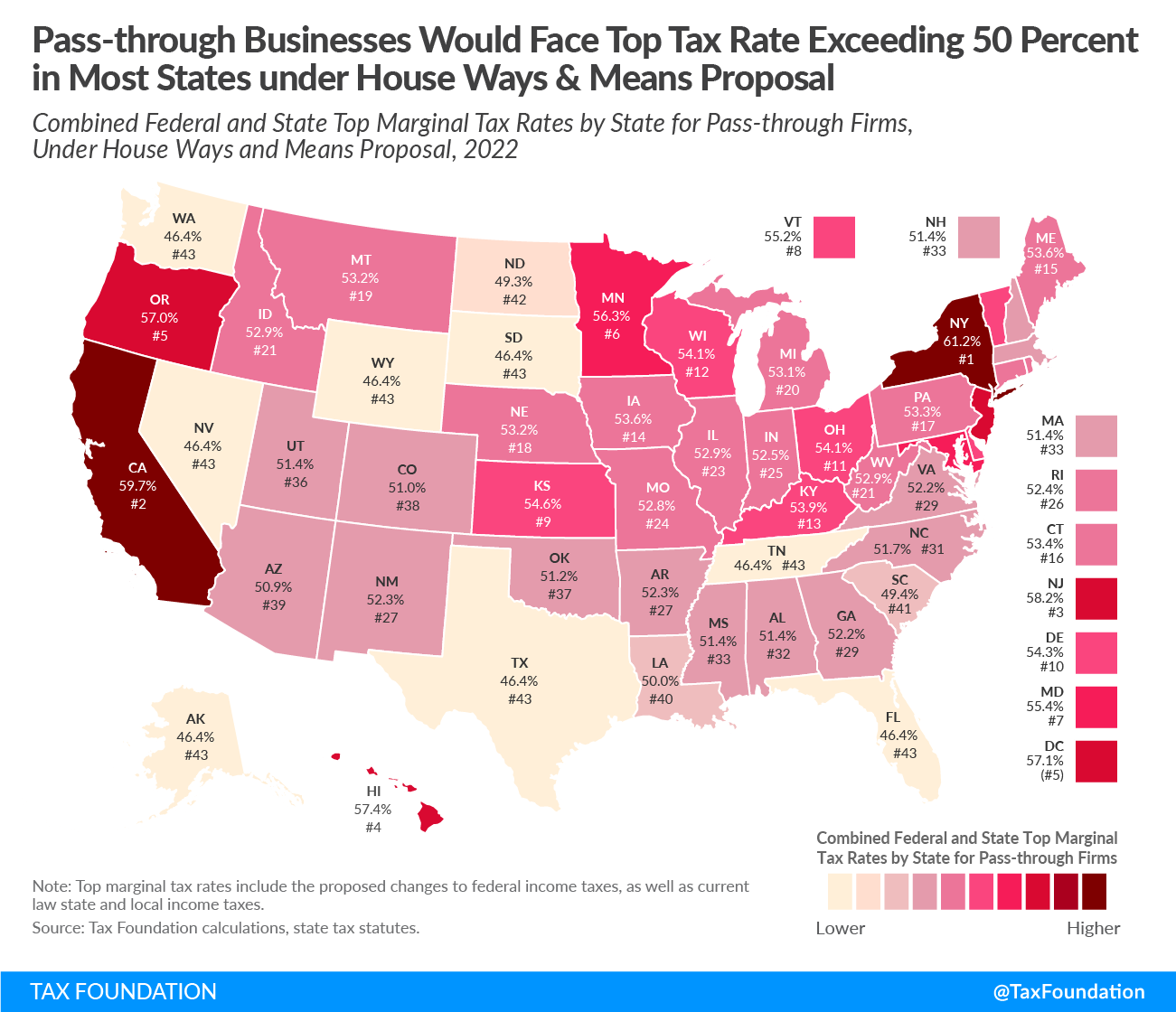

Reconciliation Bill Capital Gains Tax Proposals Tax Foundation

Continuing Developments On Tax Provisions In The Reconciliation Bill Baker Tilly

Joint Economic Committee Tax Hearing Build Back Better Revenue Items

Proposed Tax Law Changes Which May Impact You Certilman Balin

Everything In The House Democrats Budget Bill The New York Times

Federal Tax Cuts In The Bush Obama And Trump Years Itep

Will It Or Wont It Newest Reconciliation Bill Lacks Major Estate Tax Law Changes

Democrats Tweak Tax Bill For House Vote Grant Thornton

More Than 12 Billion In Lihtc Provisions And Nearly 6 Billion For Neighborhood Homes Tax Credits In Nov 3 Draft Of The Build Back Better Reconciliation Bill Would Finance Close To 1

Billionaires Tax On Capital Gains Invites Tax Collection Volatility

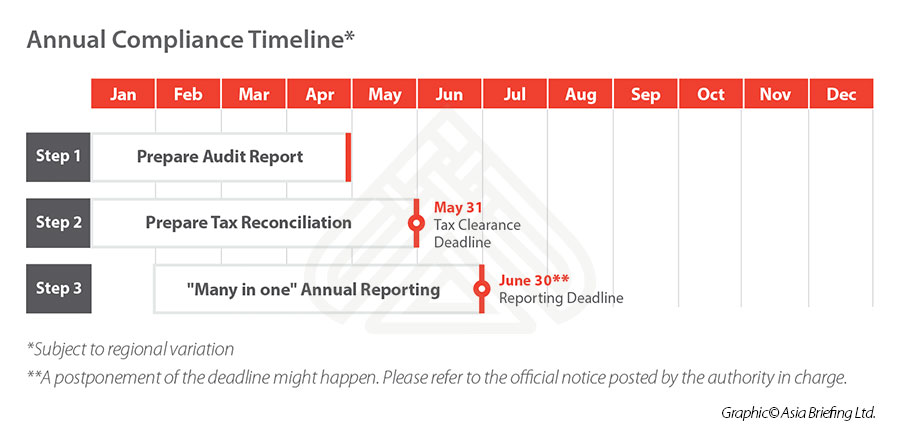

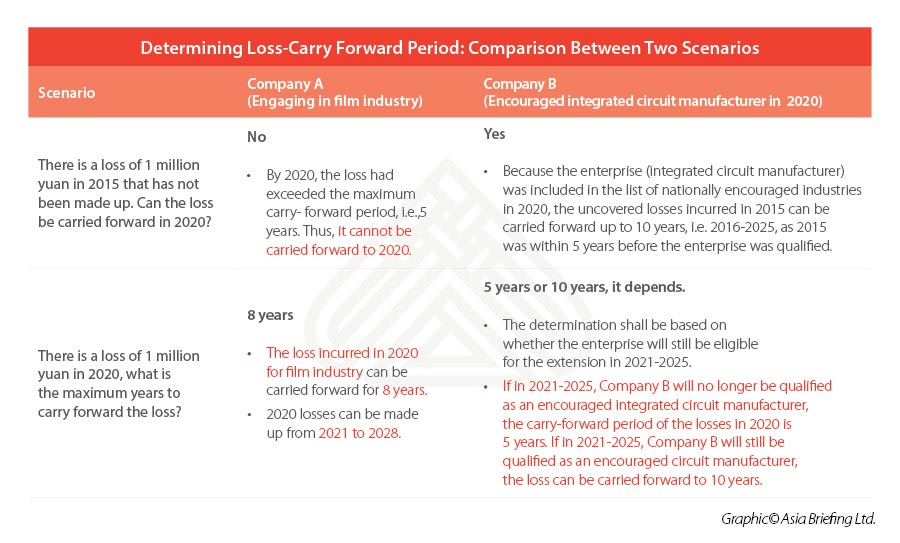

Preparing For Annual Tax Reconciliation In China In 2021 Faqs

Preparing For Annual Tax Reconciliation In China In 2021 Faqs

Higher Tax Rates For Billionaires And Corporations Can Still Fund Biden S Agenda

Increase Your Profit Money Saving Strategies Budget Saving Money Saving Tips